Tampa Wage & Hour Lawyer

Employers routinely fail to comply with Federal and State wage and hour, overtime, and minimum wage laws. The Fair Labor Standards Act (FLSA) is a federal law. FLSA requires employers to pay minimum wage and to compensate workers at an overtime rate of time and one-half their regular rate of pay for all hours worked over 40 in a workweek. Additionally, Florida has a minimum wage law and other laws that protect employees when companies fail to pay employees for all hours worked.

Wage and Hour Matters

The Tampa wage & hour lawyers at Florin Gray are committed to ensuring that all Florida employees are paid correctly and legally. We are here to help ensure that employers follow Federal and State wage and hour, overtime, and minimum wage laws.

Our attorneys have litigated class action and collective action wage & hour cases, as well as overtime cases against large organizations, including large call centers, big banks, debt collection agencies, the telecommunications industry, large parking & valet companies, diagnostic testing firms, soft drink corporations, and many others. Class and collective actions can seem intimidating at first. Florin Gray offers free initial consultations. Our free consultation will help you understand your options and are committed to making the process smooth and easy to understand.

Among the variety of wage and hour matters that we handle, these are the most common:

- Unpaid Overtime

- Off-the-Clock Work – rest and meal breaks, prep and post-work

- Misclassification, Exempt vs. Non-Exempt – Simply because an employer pays an employee a salary does not necessarily mean that the employee is not entitled to overtime compensation.

- Improper Classification as an Independent Contractor – Often, employers characterize a worker as an independent contractor when the worker is considered an employee of the company under the law.

- Unpaid Wages – including bonuses and commissions

- Improper Calculation of Overtime Rates

- Minimum Wage Violations

- Tipped Employees – Improper tip pooling and tip sharing, i.e., managers improperly sharing in employee tip pools

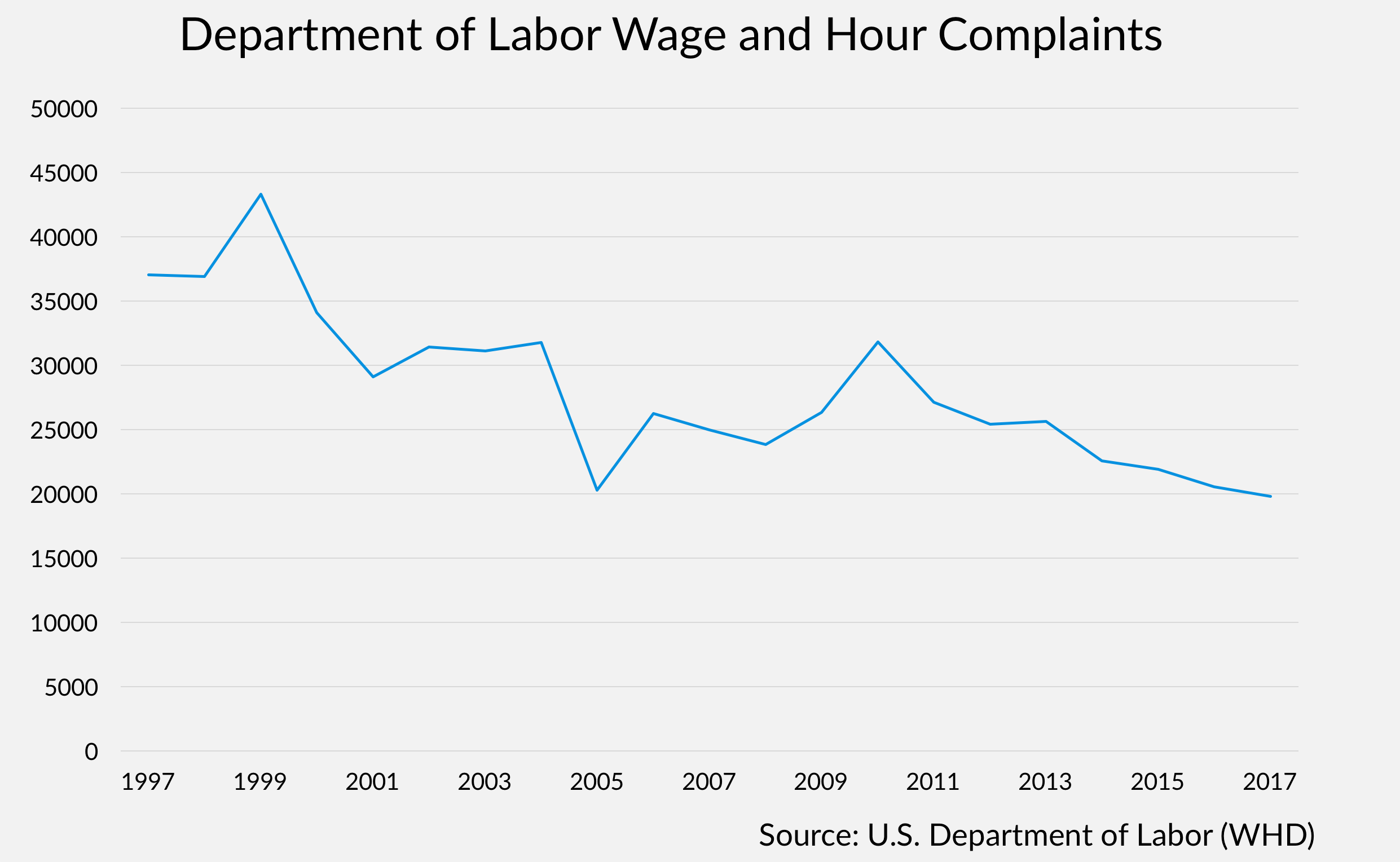

Every year, tens of thousands of U.S. employees are victims of wage theft by employers. The U.S. Department of Labor Wage and Hour Division received nearly 20,000 complaints in 2017.

Through enforcement, the Wage and Hour Division has recouped hundreds of millions of dollars in back pay for workers. Staggeringly high as they may be, these numbers only represent formal complaints and are likely a tiny fraction of the actual number of employees who have been affected.

The power dynamic between employee and employer is almost always to the advantage of the employer. Unfortunately, employers often leverage that power against employees. If your employer has taken advantage of you, get help from an experienced team of attorneys. Florin Gray fights for people whose employers have treated them unfairly. Our Tampa employment attorneys give voice to employees mistreated by the system. We help them fight against unfair employment practices, regardless of how large a business or corporation is. Big names or strong-arm tactics don’t intimidate us. We only focus on a select number of clients at a time, and we only tackle cases that we believe have merit.

The Fair Labor Standards Act

One of the most foundational pieces of legislation for workers across the country is the federal Fair Labor Standards Act. It defines a typical work week as 40 hours, sets the federal minimum wage, declares requirements for overtime work, and places restrictions on child labor. Additionally, it establishes the standard laws that affect both part-time and full-time workers for government employers and those in the private sector. When organizations violate these laws, employees may be able to file suit against them. An experienced Fair Labor Standards Act lawyer at Florin Gray can help you determine if your rights have been violated.

What the Law Requires of Employers

The Fair Labor Standards Act (FLSA) only applies to employers who have annual sales of at least $500,000 or who engage in interstate commerce. The courts have made the term “interstate commerce” broader so it can include the vast majority of workplaces. Sending United States mail to other states or using computers or calls to accept information from other states are all considered interstate commerce. Very few employers are exempt from these laws. Small farms are specifically exempt because they use far less outside paid labor than other companies.

These sets of regulations act as protections for employees.

Legal Help for Florida Employees

It is possible to have an employer who must adhere to these laws but has employees who these laws don’t protect. For instance, freelance workers and volunteers have no protection under FLSA because they aren’t technically an employee of a specific organization. However, many companies misuse contract workers. If you feel an organization or employer has dealt with you unfairly, don’t hesitate to discuss your case with our Tampa employment attorneys.

Exemptions may also include those the company considers executives, administrative employees, or professionals, but it would depend on their work within the organization.

Revisions and Additions

Because it is such a vital document for American workers and has been around for 80 years, legislators have changed and revised the Fair Labor Standards Act many times. One of the additions required men and women earn equal pay for work that requires the same skill, effort, and responsibility.

FLSA now also includes state and local hospitals and educational institutions, as well as covering most federal employees, state employees, political subdivisions, and interstate agencies.

It has expanded to set strict standards for deciding the stipulations for compensatory, or comp-time and establish specific requirements about when employers must pay for overtime work.

When You Need a Wage and Hour Attorney

There are numerous reasons why you would file a claim for unpaid wages in Tampa. The difficulty is that every claim of this sort can become very complicated.

Our attorneys can help you look at all of your options. Filing a lawsuit may seem like the best choice, but our employment lawyers can show you alternatives. Sometimes, there is a better option that may be faster and less expensive than going to court. Our attorneys will explain options and about your chances of winning for each of your options, and how much it may cost you, and what you could gain.

People are sometimes reluctant to hire an attorney because they are afraid of the cost. At our law firm, we don’t believe that cost should deter someone who needs an employment attorney in Tampa. The firm of Florin Gray works on a contingency fee basis, which means that you don’t pay anything upfront. Your initial consultation is free, and you don’t pay unless you win your case.

Wage and Hour Law

One aspect of employment law centers around fair wages and time spent at work to earn those wages. Consider the following crucial information:

Unpaid Overtime

The Fair Labor Standards Act says employers must pay people who work more than 40 hours a week one and one-half times their wage for every hour over. Some employees expect this perk, called time and a half, but there are ways companies try to avoid paying people overtime.

For instance, companies may agree to give you the same number of hours as paid time off when they ask you to work extra hours. If the pay is at the regular rate, they are avoiding paying you overtime. They may also have you work overtime one week and fewer hours the next, combining the two and paying you the regular rate for those two weeks. If in any given week you work over 40 hours, you deserve overtime compensation for those hours, no matter what happens the previous or following week.

Minimum Wage Violations

Wherever you are working, the law prevents employers from paying you less than a certain wage, called minimum wage. This wage tends to increase with inflation. In Florida, the minimum wage is $3.75 dollars higher than the federal minimum wage. Right now, the federal minimum wage is $7.25, your Tampa employer must pay you at least $12.00. If your employer is paying you less than that or if the paychecks are continuously late, you may consider filing a claim against your employer.

Employers must pay the penalty if they fail to pay you correctly. The amount of unpaid minimum wages that you claim is the difference between what your employer paid per hour and what they should have paid you per hour. Then, multiply that by the total number of hours that you worked, and that is how much your employer owes you.

Tipped Employee Issues

One of the exceptions to the minimum wage rule is if you are a tipped employee. Your employer may lower your wage if you make enough money in tips to bring you up to the regular state minimum wage. In Florida, tipped employees have a minimum wage of $8.98 as of January 1, 2023.

A tip credit is a difference between the hourly wage of tipped employees and the standard minimum wage for the state. If the tip credit and the hourly wage do not add up to match the standard minimum wage, the employer must cover the difference.

According to federal law, if an employee spends more than 20% of time doing work where they can’t earn tips, then the employer has to pay the standard minimum wage, and not the tipped employee wage.

As restaurant workers know, this can get complicated because many employers use tip pooling. This is when each employee takes a portion of his or her tips and puts it in a pool. Then, a manager or owner divides up the money among the tipped workers. The employee does not have to put in more than is reasonable and has to be able to keep at least the minimum wage. Non-tipped workers – like bussers, janitors, or hosts – should not be part of the tip pool. However, many places force wait staff to “tip out” and pay them a percentage from their earnings, despite it being against the FLSA.

There are a handful of classifications to clarify what counts as a tip. The payment must be voluntary, the customer must have freely determined it, and the customer has the right to decide who gets the tip.

Improper Classification as an Independent Contractor

One of the tricks some businesses use is to avoid paying employees a living wage, providing benefits, by calling some or all of their workers’ independent contractors. The law doesn’t entitle independent contractors to overtime pay. In fact, FLSA doesn’t protect them at all.

However, if most of your income comes from a single company, the law would most likely see you as an employee of that company. Some courts also tend to group workers with higher pay and skill as independent contractors. If you work consistent hours every day under a supervisor, you are likely not a contractor. If you work more than 40 hours a week, then your employer owes you overtime.

Misclassification

As mentioned above, there can be complications when determining who is exempt and who is non-exempt. Three of the main types of exempt employees are executive, administrative, and professional workers.

a) To be an executive worker, you have to manage others as your primary duty and, along with that, have the ability to hire, fire, and direct people. You also have to have a salary of at least $684 per week.

b) For the administrative exemption, your main job must be office work for management or administration. You must mostly use your discretion and judgment at work and make at least $684 per week.

c) To qualify as a professional worker, you have to be doing work focused in creative fields or that requires advanced knowledge. You also must make at least $684 per week.

There are many other types of workers who are exempt from coverage under the Fair Labor Standards Act, including outside salespeople, computer employees, and other miscellaneous workers.

Unpaid Wages

There are many ways that your employer could be guilty of not paying you required wages. It could come in the form of unpaid breaks, unpaid overtime, minimum wage violations, and many more.

In Florida, if your employer has not been paying you in any way, the courts may award you three times the amount they owe. You need to send you employer a notice saying you intend to file a lawsuit and then give them 15 days to settle your claim. If they do not, you can take them to court. This is not required under the Federal Law.

Work with Our Experienced Tampa Wage & Hour Attorneys

If you discover that your employer isn’t paying you fairly or your employer is otherwise mistreating you, contact Florin Gray. We only accept a small group of clients, so we can give your case the attention it deserves. To find out if your case qualifies as unfair treatment by an employer, reach out to the Tampa wage and hour lawyers at Florin Gray for a free consultation with one of our experienced attorneys to see what we can do for you.